What Is FinOps?

FinOps, or Financial Operations, is an operational framework for deriving maximal value from cloud computing, while providing the data necessary for strategic decision making, and encouraging financial accountability for the use of cloud resources. FinOps is also a cultural practice that promotes collaboration between development, finance, and business teams, with each group taking ownership for cloud usage, supported by a central FinOps group.

The FinOps approach advocates for a balance between speed, cost, and quality, ensuring that cloud investments deliver the highest value at the lowest cost. It addresses the complexities of cloud billing and promotes a culture where teams across finance, operations, and development work together.

As organizations increasingly rely on the cloud for their operations, the need for FinOps has grown. By fostering a shared understanding of cloud costs, FinOps helps businesses make more informed decisions, optimizing their cloud usage, reducing costs in the short term, and improving return on investment in the long term.

This is part of an extensive series of guides about IaaS.

What Is the FinOps Foundation?

The FinOps Foundation (see the official website) is a non-profit trade association dedicated to advancing the discipline of FinOps. It was initially founded by the Linux Foundation and is also supported by the Cloud Native Computing Foundation. It has a community of over 16,000 FinOps professionals representing more than 5000 companies.

The FinOps Foundation serves as a hub for professionals practicing FinOps, offering educational resources and a platform for community interaction. In particular, it offers respected industry certifications such as FinOps Certified Professional and AWS FinOps Certified Practitioner.

Members of the FinOps Foundation have access to a repository of best practices, benchmarking data, and case studies. The foundation also facilitates networking opportunities and collaborative learning through forums and events, most notably the FinOps X conference.

Why Cloud FinOps Adoption Is Growing

The rapid acceleration of public cloud spending has driven the growing adoption of FinOps in the cloud. Gartner has highlighted a significant surge in worldwide end-user spending on public cloud services, projecting a dramatic increase from $478 billion in 2022 to $678 billion in 2024.

This growth is indicative of the broader trend towards cloud-native infrastructure services, with over 40% of enterprise workloads expected to be deployed in the cloud. The shift towards the cloud is driven by its scalability, efficiency, and the ability to innovate quickly, but it also introduces challenges in financial management and the risk of wasteful spending.

The State of FinOps report by the FinOps Foundation sheds light on the current priorities of FinOps practitioners. 50% of FinOps experts are focused on reducing waste—the top priority. The next priorities are managing commitment-based discounts (43%), accurate spend forecasting (41%), and ensuring full allocation of cloud spending (38%).

These statistics reveal a gap in the financial management of IT resources, where over-allocating resources has become a common strategy to mitigate performance risks. Cloud FinOps has emerged to help manage these inefficiencies, providing a structured approach to optimizing cloud costs and employing best practices to maximize returns on cloud investments.

What Are the Benefits of FinOps?

FinOps offers several advantages for managing costs in the cloud:

- Reduced cloud computing costs: FinOps delivers direct savings on cloud computing costs through efficient resource management and strategic planning. By closely monitoring usage and employing cost-optimization techniques, organizations can significantly reduce wasted spend and use pricing models that best suit their needs.

- Improved financial performance: FinOps improves budget accuracy by providing detailed visibility into cloud spending, enabling better planning and forecasting. This predictability helps businesses allocate resources more effectively, optimizing investments for growth and innovation.

- Increased transparency: Through comprehensive monitoring and reporting, stakeholders gain a clear view of where and how resources are being consumed. This visibility fosters accountability, encourages responsible usage, and supports informed decision-making.

The Core Principles of FinOps

FinOps revolves around the following principles.

.png?width=1600&height=586&name=FinOps-1%20(1).png)

Collaboration

Collaboration involves finance, technology, and business units joining forces, breaking down silos to achieve a common goal. This unified approach ensures that decisions affecting cloud expenditures are made with a holistic view, combining financial insight with technical expertise.

Collaboration fosters a culture of shared responsibility. When cross-functional teams understand how their actions impact cloud costs, they become more invested in seeking cost-effective solutions. This collective also enhances operational efficiency and innovation across the organization.

Visibility

Visibility into cloud spending requires detailed insights into where and how cloud resources are used. This is essential for identifying inefficiencies and opportunities for cost savings. Tools and platforms that provide real-time monitoring and reporting of cloud usage can help achieve this visibility.

With adequate transparency, organizations can allocate costs accurately, understand usage patterns, and plan budgets more effectively. It also enables teams to make data-driven decisions, adjusting their cloud resources to match actual needs, thereby avoiding waste and optimizing their cloud spend.

Accountability

Accountability in FinOps refers to assigning responsibility for cloud costs to the appropriate teams or individuals. This principle ensures that those who have the power to influence cloud usage are aware of their impact on the budget. By holding teams accountable, organizations encourage more conscientious use of cloud resources, driving down unnecessary expenses.

Implementing accountability requires clear communication of cost management goals and metrics. When each team knows their cost targets and understands the consequences of exceeding them, it promotes a cost-aware culture that contributes to the overall financial health of the organization.

Reporting

Effective reporting provides stakeholders with insights into cloud spend trends, efficiency, and opportunities for improvement. Reports should be comprehensive but digestible, enabling quick understanding and action. Automating reporting processes and customizing reports to meet the needs of different stakeholders can enhance their value.

Timely and accurate reporting supports better decision-making. It allows organizations to track their progress against financial targets, identify variances early, and adjust strategies as needed. Regular reporting also keeps cloud costs front and center, maintaining focus on optimization efforts.

Centralization

Centralization of cloud financial management within the FinOps framework brings coherence to cost optimization efforts. It entails establishing a centralized team or platform where cloud spending can be monitored, analyzed, and managed. This central point of oversight streamlines cloud cost management by consolidating data and resources.

Centralization simplifies governance and compliance, ensuring that cloud usage aligns with organizational policies and objectives. It also enables better negotiation of cloud contracts and bulk purchasing, leveraging the organization's collective spending power for better rates and terms.

Optimization

Optimization in FinOps focuses on continuously improving the efficiency of cloud spending. It involves analyzing consumption patterns, right-sizing resources, and choosing cost-effective services and pricing models. Optimization is an ongoing effort, requiring regular review and adjustment to align with changing needs and opportunities.

By prioritizing optimization, organizations can maximize the value of their cloud investments. Effective optimization reduces waste, lowers costs, and supports scalability. It ensures that cloud resources are utilized optimally, contributing to both financial savings and operational excellence.

The 3 Phases of the FinOps Lifecycle

FinOps processes can be divided into three main phases: inform, optimize, and operate.

.png?width=1270&name=FinOps%20(1).png)

Inform

This phase aims to provide stakeholders with a clear understanding of cloud costs and usage. It involves collecting and analyzing data on cloud expenditure, establishing benchmarks, and setting targets. Awareness and education about cloud financial management practices are also key components.

Optimize

During the optimization phase, organizations actively seek ways to reduce cloud costs without compromising performance or scalability. This involves implementing cost-effective strategies, such as selecting the right pricing models, optimizing resource allocation, and eliminating inefficiencies. Continuous monitoring and analysis support these efforts, ensuring that optimization actions are based on up-to-date information.

Operate

This phase focuses on the day-to-day management of cloud resources in alignment with financial targets and operational requirements. It encompasses implementing governance policies, ensuring compliance, and facilitating smooth workflows. The goal is to maintain control over cloud spending while supporting overall business objectives.

FinOps vs. DevOps: What Is The Difference?

FinOps and DevOps are distinct disciplines with complementary objectives.

DevOps focuses on enhancing the speed, quality, and reliability of software development and delivery. It aims to break down barriers between development and operations teams, fostering continuous integration and deployment.

FinOps centers on optimizing cloud financial management. It bridges the gap between finance, technology, and business units, ensuring efficient use of cloud resources. By integrating FinOps and DevOps practices, organizations can achieve a balance between innovation and cost efficiency, accelerating growth while maintaining financial control.

Who Are the Key FinOps Stakeholders?

.png?width=1270&name=FinOps-2%20(1).png)

Executives

Executives provide strategic direction and integrate financial governance into the company's cloud strategy. They ensure the alignment between cloud investments and business objectives, promoting accountability and efficiency. Executives sponsor initiatives, set policies, and are ultimately responsible for the financial health of cloud consumption.

Business and Product Owners

Business and product owners bridge the gap between technology and business, focusing on maximizing the value derived from cloud investments. They articulate business needs, oversee cloud cost implications, and ensure that projects align with strategic goals. Their role is to justify cloud expenses by linking them to business outcomes and revenue opportunities.

Engineering and Operations Teams

The engineering and operations teams implement cloud solutions that meet technical and budgetary requirements. They select, manage, and optimize cloud resources to ensure operational excellence. These teams work closely with finance to understand budget constraints and employ technical strategies to control expenditure without compromising system performance or reliability.

Finance and Procurement Teams

Finance and procurement teams oversee financial aspects of cloud spending, including budgeting, forecasting, and vendor negotiations. They establish processes for procurement and cost control, working with other stakeholders to ensure cloud expenditures align with financial objectives.

FinOps Practitioners

FinOps practitioners are specialists who operate at the intersection of finance, technology, and business, dedicated to optimizing cloud costs. They implement FinOps practices, tools, and methodologies to manage cloud spending effectively. These practitioners work across teams, promoting collaboration and sharing best practices for financial management of the cloud.

What Is FinOps Reporting?

Reporting is a critical component of FinOps, focusing on the creation, analysis, and dissemination of detailed reports about an organization's cloud spend and usage. This process enables stakeholders to gain insights into their cloud expenditures, identify cost-saving opportunities, and make informed decisions to optimize cloud resources efficiently.

For example, a typical FinOps report might include breakdowns of cloud spending by department, project, or service, highlighting areas where costs exceed budgets or where efficiencies can be gained. Another report might compare month-over-month spending, providing insights into trends and helping to forecast future expenditures. These reports are instrumental in maintaining budget control, ensuring resources are used efficiently, and supporting strategic planning efforts.

Furthermore, advanced reporting might involve the use of predictive analytics to forecast future cloud spending based on historical data and current usage patterns. This can help organizations anticipate and plan for spikes in demand or identify opportunities to adjust their cloud infrastructure proactively to save costs. Reports on cost optimization efforts, such as the outcomes of resource right-sizing or the adoption of reserved instances versus on-demand pricing, offer concrete evidence of savings and efficiencies gained through FinOps practices.

What Are FinOps Tools?

FinOps tools are specialized software solutions designed to help organizations manage, optimize, and report on their cloud spending. These tools offer features such as cost visibility, analytics, budgeting, forecasting, and optimization recommendations, all aimed at improving the financial management of cloud resources.

By using FinOps tools, businesses can gain deeper insights into their cloud usage patterns, identify inefficiencies, and implement strategies to reduce costs while maintaining or enhancing service levels. These tools can automate many aspects of cloud financial management, from monitoring and reporting to optimization and governance.

Key features of FinOps tools include:

- Cost visibility and analytics: FinOps tools offer detailed insights into cloud spending and usage. They aggregate financial data across cloud platforms, providing comprehensive reports and dashboards. With granular visibility, organizations can identify trends, anomalies, and opportunities for cost optimization.

- Cost optimization recommendations: FinOps tools provide cost optimization recommendations by analyzing cloud usage patterns and identifying inefficiencies. They suggest actionable strategies for rightsizing resources, choosing cost-effective services, and eliminating waste. They also let users set policies and define alerts to help enforce cost-saving measures, ensuring continuous optimization.

- Marketplace and price comparison: These features enable organizations to evaluate different cloud services and vendors. They offer insights into pricing models, discounts, and alternative solutions, helping stakeholders make cost-effective decisions. They facilitate vendor selection based on price-performance ratios.

- Collaboration and reporting: FinOps tools provide platforms for communication and information sharing, streamlining workflows and decision-making processes. Reporting functionality delivers tailored insights to various stakeholders, highlighting areas of concern and success.

- Integration with cloud and finance systems: Integration with cloud and finance systems allows for seamless data flow and automation. These integrations enable the consolidation of financial, operational, and cloud usage data, providing a holistic view of cloud expenditures. Automated data collection and processing reduce manual efforts and errors, enhancing accuracy and timeliness.

Practicing FinOps with Leading Cloud Providers

The leading cloud service providers offer various tools and capabilities for implementing FinOps strategies.

FinOps on AWS

Amazon Web Services (AWS) provides a suite of native tools designed to support FinOps practices, enabling businesses to monitor, manage, and optimize their cloud spend. For example, AWS Cost Explorer allows users to visualize and analyze their AWS spending over time, identifying trends and pinpointing cost drivers. The AWS Budgets tool lets organizations set custom budgetary controls and receive alerts when cloud spending exceed limits.

In addition, AWS Savings Plans and Reserved Instances provide options for committing to specific usage levels in exchange for significant discounts, encouraging cost-effective consumption patterns. Amazon also offers Spot Instances and serverless computing services, which can help drive down costs for certain use cases.

Learn more in our detailed guide to AWS FinOps

FinOps on Azure

Microsoft Azure supports FinOps practices through a variety of tools and services that focus on cost management and optimization. Azure Cost Management + Billing is a key tool that offers capabilities for tracking, analyzing, and optimizing cloud costs. Azure Advisor is an automated cloud consultant that provides recommendations on how to optimize Azure resources for cost, performance, availability, and security.

With Azure Advisor, organizations can make informed decisions about scaling resources and selecting the appropriate pricing models, such as Azure Reservations, Azure Spot VMs, and Azure Hybrid Benefit, to receive substantial discounts on Azure resources.

Learn more in our detailed guide to Azure FinOps

FinOps on Google Cloud

Google Cloud provides a set of tools that support FinOps principles, including Google Cloud Cost Explorer, Budgets, and Reports. These tools allow organizations to monitor their cloud spending, set budgets, and receive alerts to prevent overspending. These tools also offer detailed breakdowns of costs by project, service, and location, enabling tracking and management of cloud costs.

Google Cloud also offers the Recommender API, which delivers personalized recommendations for optimizing Google Cloud resources. This includes suggestions for resizing instances, deleting unused resources, and adopting cost-effective pricing plans like Committed Use Discounts and Spot VMs. In addition, Google Cloud offers extensive documentation and best practices that can help achieve efficient cloud spending patterns.

FinOps on OCI

Oracle Cloud Infrastructure (OCI) provides tools and features that help customers manage cloud budgets and optimize resource use. OCI's Cost Management Dashboard offers detailed insights into spending, highlighting opportunities for cost reduction. Users can set budget limits and receive alerts through OCI’s budgeting tools, which prevent unexpected expenditures.

The platform also provides analytical tools for deep dives into spending by service, region, or tags. Automated recommendations advise users on resource configuration optimizations and pricing plan adjustments.

FinOps for Kubernetes

Implementing FinOps in Kubernetes environments focuses on efficient resource management and cost control for containerized applications:

- Tools like Prometheus and Grafana offer real-time monitoring and visibility, important for managing resources effectively in Kubernetes.

- Implementing tagging strategies using Kubernetes namespaces and labels helps in attributing costs accurately to specific projects or teams.

- Right-sizing resources can be achieved with tools like Horizontal Pod Autoscaling and Vertical Pod Autoscaling, which adjust resource allocation based on actual demand.

- Specialized tools provide insights into spending and help identify optimization opportunities.

Policy enforcement with tools like Open Policy Agent ensures adherence to budgetary constraints, aligning resource deployment with financial objectives.

FinOps Best Practices

Here are some best practices for implementing FinOps in your cloud environment.

Define Budgets and Forecasts

A first step to practicing FinOps is to establish clear budgets for their cloud expenses, aligned with business objectives and operational needs. Forecasting future cloud spend is critical for anticipating costs, identifying potential overspends, and making informed decisions.

Regular review and adjustment of budgets and forecasts ensure they remain relevant and accurate, reflecting changes in business strategy and cloud usage. This practice supports financial control, enabling organizations to optimize cloud investments and avoid unexpected expenses.

Set Roles and Responsibilities

Organizations should define specific duties for managing cloud costs, ensuring team accountability. Assigning roles such as FinOps practitioners, financial analysts, and cloud architects facilitates effective collaboration and responsibility sharing.

Clear delineation of roles supports efficient cost management processes, from budgeting and forecasting to optimization and reporting. It encourages a culture of financial accountability and enhances the organization's ability to manage cloud spending effectively.

Adopt a Cloud Resource Tagging Strategy

Tags allow organizations to categorize cloud assets based on factors such as cost center, environment, and project. This granularity provides insights into resource utilization and spending patterns, supporting cost allocation and optimization.

Effective resource tagging enables granular reporting and analysis, facilitating informed decision-making and cost-saving strategies. This approach improves visibility and control over cloud expenditures, driving efficiency and accountability.

Implement Governance and Policy Management

Organizations should establish policies for cloud usage, cost management, and security, ensuring alignment with business objectives and regulatory requirements. Governance frameworks provide mechanisms for monitoring compliance, managing risks, and enforcing policies.

Strong governance and policy management practices protect the organization's interests, optimize cloud spending, and ensure responsible use of cloud resources.

Leverage FinOps Metrics and KPIs

Organizations should identify relevant metrics, such as cost per workload, utilization rates, and cost optimization savings. Tracking these Key Performance Indicators (KPIs) provides insights into financial performance, enabling continuous improvement and alignment with strategic goals.

By focusing on meaningful FinOps metrics, organizations can monitor progress, benchmark performance, and drive accountability. This promotes data-driven decision-making and enhances the value derived from cloud investments.

Estimate the Total Cost of Open Source and Proprietary Software

Organizations should consider direct costs, such as subscriptions and licenses, and indirect costs like support, maintenance, and integration. Comparing the long-term costs and benefits of open source versus proprietary solutions helps in making informed decisions.

Understanding the financial implications of software choices enables optimized spending and strategic investment in technology solutions. It ensures that organizations are leveraging the most cost-effective and suitable software for their needs.

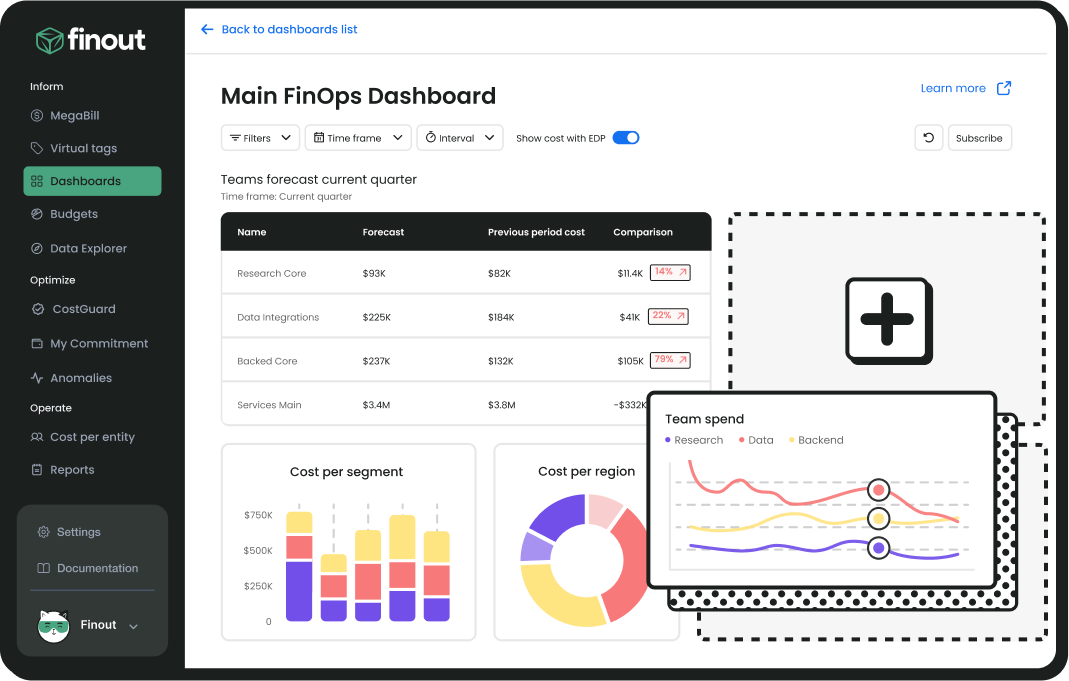

Embracing FinOps with Finout: The Optimal Path to Financial Operations Mastery

Embarking on your FinOps journey or seeking to refine your approach as an experienced practitioner, Finout stands as the unparalleled choice for an enterprise-grade FinOps solution. Whether you're navigating the initial stages of your financial operations journey or you're a seasoned expert aiming for a nuanced understanding of your expenditure, Finout emerges as the go-to solution.

Our platform offers seamless integration and comprehensive support for all major hyperscalers and essential cloud services, including Snowflake and Datadog. This ensures a robust FinOps framework that adeptly addresses the complexities of cost allocation, attribution, and observability challenges. Furthermore, Finout enriches this framework with a sophisticated governing layer equipped for anomaly detection, budgeting, and forecasting at a per-unit cost level.

Yet, the capabilities of Finout extend beyond these foundational features. Our "FinOps in a Click" dashboards redefine user-friendliness, offering insightful data at your fingertips, designed to enhance your decision-making process without overwhelming you with unnecessary complexity.

Curious to delve deeper into how Finout can revolutionize your financial operations? We invite you to schedule a session with our team. Discover firsthand how Finout's cutting-edge solutions can align with your objectives, driving efficiency and clarity across your financial operations.

See Additional Guides on Key IaaS Topics

Together with our content partners, we have authored in-depth guides on several other topics that can also be useful as you explore the world of IaaS.

AWS Cost Optimization

Authored by Finout

- [Guide] Top 5 Free & Open Source AWS Cost Optimization Tools

- [Guide] Top 10 AWS Cost Optimization Best Practices & Why You Need Them

- [Webinar] How To Create a Cost-Effective AWS Environment

- [Product] Finout | Enterprise-Grade FinOps Platform

Load Balancer

Authored by Radware

- [Guide] What is a Load Balancer? History, Key Functions, Pros and Cons

- [Guide] What Is Global Server Load Balancing (GSLB) & Top 3 Benefits

- [Product] Radware Alteon | Application Delivery and Security

AWS Secrets Manager

Authored by Configu

- [Guide] AWS Secret Manager: Features, Pricing, Limitations & Alternatives

- [Blog] The state of config file formats: XML vs. YAML vs. JSON vs. HCL

- [Product] Configu: Configuration Management Platform

![What Is Kubernetes? Definitions, Components & Use Cases [2025]](https://www.finout.io/hs-fs/hubfs/k8s18-Kuberenetes%20Pricing-1.png?width=1200&height=688&name=k8s18-Kuberenetes%20Pricing-1.png)